The Central Provident Fund (CPF) system in Singapore plays a crucial role in retirement planning, home ownership, and healthcare security. As part of its ongoing policy evolution, the CPF Board has announced key changes to the CPF contribution table effective from 2025, aimed at enhancing long-term financial security for workers. These updates carry significant implications for both employees and employers, especially in the way salaries are structured and retirement planning is approached.

A Closer Look at the Updated CPF Contribution Rates

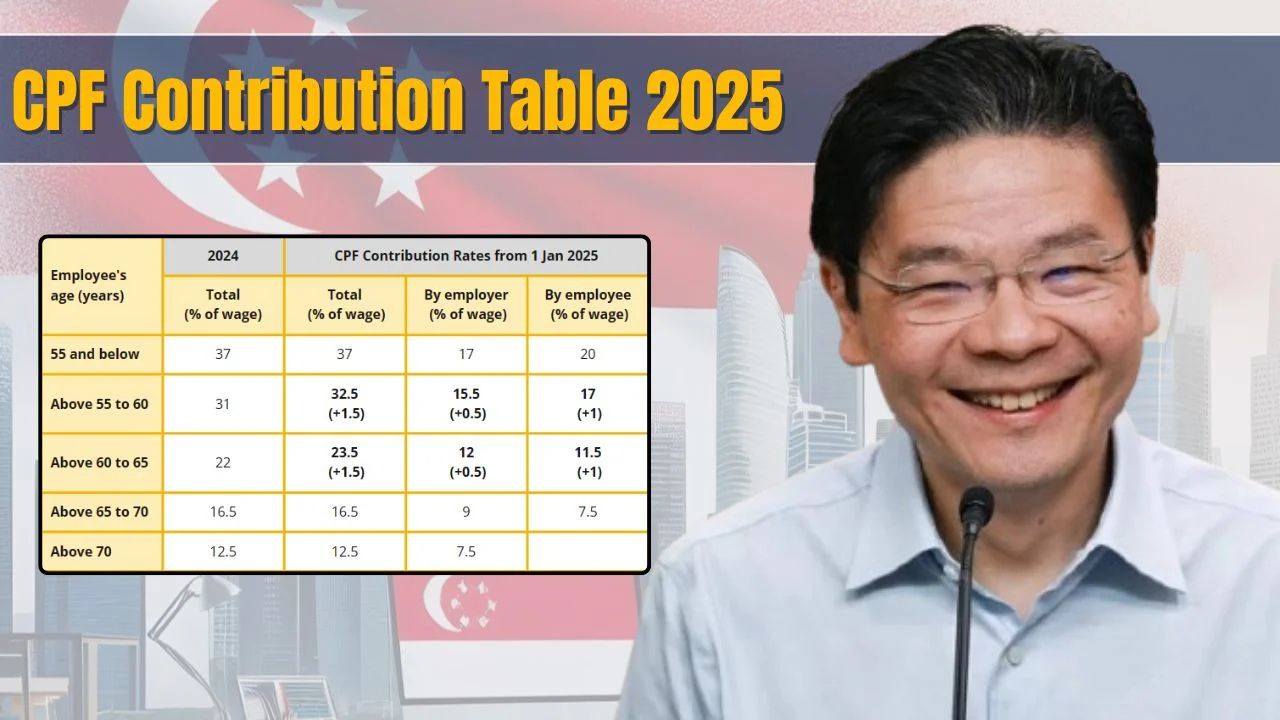

From 2025, CPF contribution rates will be adjusted, particularly for older workers aged 55 to 70. This move is part of the government’s previously announced plan to gradually raise contribution rates for senior employees, in line with efforts to support longer working lives and ensure adequate retirement savings. For workers aged 55 to 60, the combined employer-employee contribution rate will rise closer to the full 37%, narrowing the gap between their contributions and those of younger employees.

This change is designed to be gradual and sustainable, ensuring that employers have time to adjust their payroll costs while workers benefit from greater long-term financial support. Workers aged 60 to 70 will also see their contribution rates increase modestly, aligning with Singapore’s strategy to promote active aging and financial resilience.

Implications for Employees: More Savings, Less Take-Home

While higher CPF contributions mean more money stashed away for retirement, it also means a slight reduction in take-home pay for affected employees. However, this trade-off is widely considered positive for long-term financial health. The additional contributions go directly into the CPF accounts Ordinary Account (OA), Special Account (SA), and MediSave supporting home loans, retirement income, and medical needs.

For younger employees under the age of 55, there are no major changes to contribution rates. However, with continued emphasis on self-reliance and retirement adequacy, CPF enhancements in other areas such as interest rates and voluntary top-ups remain in focus.

Employers Must Prepare for Higher Payroll Costs

For employers, the updated CPF contribution table means an increase in labor costs, particularly when hiring or retaining older workers. Businesses must reassess their budget planning and consider whether to revise salary structures, benefits, or employment terms for senior employees. However, the government is expected to continue offering transitional support such as the CPF Transition Offset to help businesses manage the cost impact during the adjustment period.

In sectors with a larger population of older employees like manufacturing, logistics, and retail the changes may require broader manpower and operational adjustments. But these updates are aligned with Singapore’s larger employment strategy of encouraging companies to retain older, experienced talent.

CPF System Becomes More Progressive and Inclusive

The 2025 CPF contribution update is part of a broader effort to keep the system fair and inclusive. With rising life expectancy and evolving work patterns, CPF contributions are being recalibrated to ensure all Singaporeans have a stable and sufficient income in their retirement years. The adjustments also signal a long-term policy direction: that the CPF system will continue adapting to the realities of a maturing population and an extended workforce lifespan.

Beyond just rates, discussions around CPF are likely to expand in the coming years to include flexibility in withdrawals, targeted support for lower-income groups, and better integration with private retirement schemes. The 2025 changes may be a step forward, but they are also a sign of more transformation to come.

What Should CPF Members Do Now?

For employees, especially those approaching age 55 or older, it’s a good time to revisit financial plans, understand the impact of the revised contributions, and explore how the extra savings can support housing, retirement, or medical goals. Employers, on the other hand, need to stay informed, update HR systems, and communicate the implications clearly to their staff. Both sides benefit from being proactive rather than reactive to these policy shifts.

Conclusion

The CPF Contribution Table 2025 changes reflect Singapore’s evolving demographic and economic needs. While it means some immediate changes for payroll and net income, the long-term outlook is positive a more robust retirement system that better supports an aging but still economically active population. As always, staying informed and planning ahead remains key to making the most of CPF’s evolving framework.